Accounting in Vietnam is not complicated as long as you know the legislation, however, most people choose to use the specialized services of professional accountants in Vietnam. Living and running a business in Vietnam also implies paying taxes. These depend on the type of income obtained and are usually linked to following specific accounting requirements, meaning filing tax returns, financial statements, and other relevant documents. In this article, you will read about our accounting services in Vietnam. For expats, we also offer services related to immigration to Vietnam.

| Quick Facts | |

|---|---|

| Tax registration support (YES/NO) | We provide tax registration services for companies in Vietnam. |

|

VAT registration services (YES/NO) |

Yes, our accountants in Vietnam offer VAT registration services to foreign and local companies. |

|

Payroll and HR assistance (YES/NO) |

We provide payroll manangement, HR, employment and other Labor Law related matters support. |

| Audit services (YES/NO) | Yes, we have auditors specialized in offering various types of audits in Vietnam. |

| Bookkeeping services (YES/NO) | Bookkeeping is one of the main services provided by our specialists. |

| Financial statement filing services (YES/NO) | Yes, we are at your service with timely filing services associated with financial statements and other accounting documents as requested by the law. |

| Accounting services for foreign companies in Vietnam (YES/NO) |

Yes, our accountants are at the services of foreign companies operating through branches and subsidiaries in Vietnam. |

| Accreditted accountants availability (YES/NO) |

Yes, our accountants are members of the Association of Certified Public Accountants in Vietnam. |

| Personal income tax rate | Personal income tax is levied at progressive rates ranging from 5% to 35%. |

| Corporate tax rate | The standard rate is levied at 20%, however, companies in the oil and gas sector are imposed the tax at rates ranging from 32% to 50%, while companies operating in the mineral resources extraction sector are taxed at rates from 40% to 50%. |

| VAT rate |

The standard rate is 10%; there is also a reduced 5% rate available for certain foods and imported and exported goods. |

| Taxation of foreign employees |

Foreign employees are subject to a flat tax of 20% for their employment income. |

| Access to double tax treaties (YES/NO) |

Yes, Vietnam has approximately 80 double tax treaties. |

| Tax advice and planning services (YES/NO) | Yes, we are at the disposal of companies needing tax advice and planning solutions. |

| Other services | Our accountants in Vietnam also offer assistance in accessing various tax incentives and grants for companies, taliored accounting services for small enterprises. |

| Accounting services for sole traders (YES/NO) | Yes, our services address sole proprietorships in Vietnam. |

|

Accounting services for SMEs (YES/NO) |

Yes, we also offer support to small and medium-sized enterprises (SMEs). |

|

Accounting periods |

– monthly, – quarterly, – annually |

| Special taxes for foreign investors/companies (if any) |

– business license tax, – foreign contractor tax, – special consumption levy |

| Taxation of branches of foreign companies |

Branches are subject to the same tax regime as domestic businesses. |

| Representation with tax authorities (YES/NO) |

Yes, we offer local representation in Vietnam. |

| VAT registration threshold |

None |

| Dividend tax rate |

No withholding taxes apply resident and non-resident businesses. |

| Payroll tax rates |

– employees pay 8% as social insurance charges, – companies pay 17.5% as social security premiums |

| Financial statement filing deadlines | March 30th of the current year for the past one |

| Applicable accounting standards |

Local rules, however, starting with 2025 International Financial Reporting Standards will be implemented. |

| Tax authorities in Vietnam |

General Tax Department, Ministry of Finance |

| Tax registration timeframe (approx.) |

5 to 10 business days |

| VAT registration timeframe (approx.) |

Approx. 10 days |

| Advantages of working with an accounting company in Vietnam |

– access to various services; – customized accounting solutions; – tailored services based on company size, etc. |

Table of Contents

What are the main services provided by an accounting firm in Vietnam?

The services provided by accountants in Vietnam can be simple or complex, depending on the clients’ needs. Among them, here are the most often requested:

- tax and VAT registration for companies are some of the most solicited accounting services in Vietnam;

- bookkeeping and accounting services are also requested by business owners;

- payroll and HR services are complex tasks that can be handled by our accountants in Vietnam;

- tax consulting and planning solutions in order to make mid-term and long-term projections and to calculate investments are also in demand;

- audit services, as companies must respect various standards related to accounting in Vietnam;

- preparing and filing financial statements, including VAT returns for Vietnamese companies are also on the list of services provided by our specialists.

Our accountants in Vietnam are at your disposal with tailored packages, meaning that you can choose the service or services you need. Skip the additional costs and administrative burden associated with creating an accounting department, by using external resources.

Vietnam is full of people from all over the world who have settled here for a long term. The low cost of living has attracted a wide range of expats, including foreign employees, multinational executives, entrepreneurs, retirees, and digital nomads among those who have opted for immigration to Vietnam due to the good living conditions.

If you are a foreign citizen or businessperson and want to move here, our immigration lawyers in Vietnam can help you apply for the appropriate residence or investment permit.

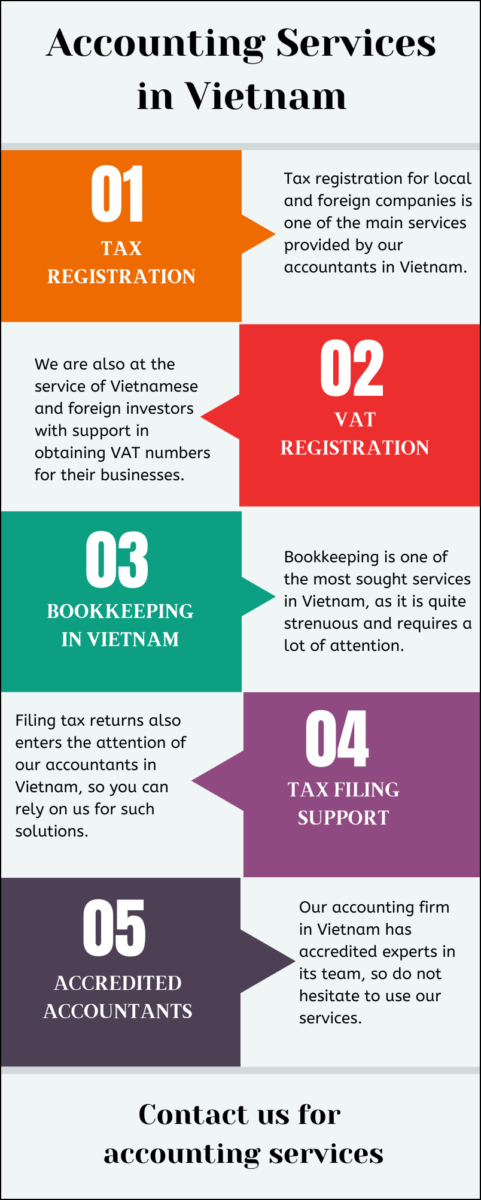

Feel free to address to our accountants in Vietnam for more information on this important tax. Here is an infographic on our accounting services:

Tax and VAT registration support

When starting a business in Vietnam, the tax and VAT registration procedures are among the formalities that need to be completed alongside the company incorporation process.

The tax and VAT numbers are issued by the General Taxation Department and the procedure can be handled by our accountants in Vietnam.

Since the value added tax is one of the most important taxes in Vietnam, it is worth noting that it applies a standard rate of 10%, however, a 5% reduced rate is available for food, transport services, medical equipment, agricultural-related products and services.

Bookkeeping and accounting services in Vietnam

One of the most important solutions clients can rely on our accountants in Vietnam is related to bookkeeping and accounting. Before offering the respective services, our specialists will first configure the accounting system. However, we can also use our dedicated software, in order to start right away.

From there, we will compile the following documents related to bookkeeping and accounting in Vietnam:

- invoices;

- lists of accounts and ledgers;

- reports;

- accounting policies and procedures, etc.

Apart from the preparation of the accounting documents, we also offer the following services:

- input and output document verification in order to adhere to local and international accounting standards;

- classification of accounting records and documents;

- preparation of accounting books;

- handling tax filing and invoice registration;

- preparing tax reports and submitting them on time, such as monthly, quarterly, or yearly, to the tax authorities;

- handling the licensing tax.

Our accounting firm in Vietnam is at the service of all types of companies, no matter their size.

Payroll services in Vietnam

Hiring employees in Vietnam is a two-step process from an accounting point of view:

- the first one implies respecting the provisions of the Labor Code which provides for the establishment of the base salary, payment dates, overtime payments, etc.

- the second one refers to the actual implementation of the payroll system which implies registering the information mentioned above for each employee.

Our accountants in Vietnam will first set up the payroll system which implies enrolling each employee in it for the payment of the income tax and social security contributions. Then, all relevant documents must be filed with the authorities, another aspect we can handle.

Payroll is one of the most complex matters when it comes to accounting in Vietnam due to several reasons, among which:

- it requires respecting various laws that can be subject to changes or updates;

- employee turnover which implies keeping track of new workers and people who leave the company;

- special requirements to comply with in the case of foreign employees.

When it comes to foreign employees, we are also at your disposal with solutions related to personnel immigration to Vietnam.

Audit services in Vietnam

Local companies are required to file audited accounts on a yearly basis, which is why they can rely on our accounting firm in Vietnam. Our auditors can perform both external and internal audits, where the former can be used by business owners to determine the performance of their enterprises.

We will prepare the annual financial statement in accordance with Vietnamese audit regulations. However, additional audit responsibilities could appear at any time during the year (for example, for enterprises with foreign investment).

Apart from these, we are also at your service with compliance audits, in order to make sure the corporate governance regulations are fully compliant.

Accounting services in Vietnam tailored to the specific of your business

Our accountants in Vietnam respect the principles that stand at the base of each business from the following points of view:

- operational industry, as different reporting and tax requirements may apply;

- foreign or locally-owned entity, given the fact that in the case of the former additional rules apply;

- size of the company, as our accounting firm in Vietnam can help sole traders, as well as large enterprises operating in this country.

Apart from these, we remind you about our immigration services, which support obtaining residency in Vietnam.

Here is also a video on our services:

Specialized accountants in Vietnam

Accounting in Vietnam has its own particularities, just like in other countries. This means that tax returns must be drafted and filed at specific periods, invoices must be issued and recorded under various conditions, and so on.

You no longer need to worry about such tasks when using the services of accounting firm in Vietnam. Our accountants in Vietnam are here to help.

Here are a few things to consider when it comes to filing tax returns in this country:

- the financial year in Vietnam starts on January 1st and ends on December 31st, thus coinciding with the calendar year;

- there are 2 accounting periods in Vietnam, the monthly one and the quarterly one;

- the corporate tax is set at a standard rate of 20%, however, for oil and gas businesses, the rates range from 32% to 50%;

- annual financial reports must be filed by March 30th of the following year.

An important change to occur by 2025 is for all companies to fall in line with International Financial Reporting Standards.

For more information on accounting in Vietnam and our services, please contact us.

For foreigners planning to stay in this country for a long time, a residence permit is the ideal option. However, under specific conditions and with very few restrictions, foreigners may get permanent residency in Vietnam in accordance with Ordinance No. 24/2000. You can rely on our local specialists for support in obtaining a residence visa.